marketingways.ru

Recently Added

Grant Money For Startups

NIH's SEED Fund: Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Plus entrepreneurial and product. “The Amber Grant offers three $10, grants to women-owned businesses each month. Then, at the end of each year, WomensNet gives an additional $25, to three. Want to launch your dream business but need funding? Here's a guide to applying for small business grants and the top grants for underrepresented founders. Nebraska Innovation Fund Prototype Grants Competitive matching grant that provides financial assistance to Nebraska businesses for product development. The Department of Housing and Community Development (DHCD) through the Neighborhood BusinessWorks (NBW) program, is offering up to $2,, of Business Boost. The One North Carolina Fund (OneNC) is a discretionary cash-grant program that allows the Governor to respond quickly to competitive job-creation projects. The. The Google for Startups US Black Founders Fund provides $K cash awards — without giving up equity in return — along with product credits, and hands-on. HerRise Micro-Grant - Monthly Awards · Amber Grant · SoGal Foundation Grants · $5,$25, Grants for Your Small Business · The FedEx® Entrepreneur Fund. Eligibility · Must have minimum revenues of $, within the trailing 12 months. · Business must be able to demonstrate a minimum of $, in. NIH's SEED Fund: Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs Plus entrepreneurial and product. “The Amber Grant offers three $10, grants to women-owned businesses each month. Then, at the end of each year, WomensNet gives an additional $25, to three. Want to launch your dream business but need funding? Here's a guide to applying for small business grants and the top grants for underrepresented founders. Nebraska Innovation Fund Prototype Grants Competitive matching grant that provides financial assistance to Nebraska businesses for product development. The Department of Housing and Community Development (DHCD) through the Neighborhood BusinessWorks (NBW) program, is offering up to $2,, of Business Boost. The One North Carolina Fund (OneNC) is a discretionary cash-grant program that allows the Governor to respond quickly to competitive job-creation projects. The. The Google for Startups US Black Founders Fund provides $K cash awards — without giving up equity in return — along with product credits, and hands-on. HerRise Micro-Grant - Monthly Awards · Amber Grant · SoGal Foundation Grants · $5,$25, Grants for Your Small Business · The FedEx® Entrepreneur Fund. Eligibility · Must have minimum revenues of $, within the trailing 12 months. · Business must be able to demonstrate a minimum of $, in.

A grant is money that is given to a person, business, or corporation by a federal, state, county, or local government. Private businesses or corporations may. The federal government offers grants with opportunities for companies from varying backgrounds. At the federal level, marketingways.ru provides limited small business. Small Business Innovation Research (SBIR) program. This grant is provided so that you can contribute to technological development and commercialize your project. PepsiCo Juntos Crecemos Grant Program. In collaboration with Hello Alice, the PepsiCo Juntos Crecemos program is providing $10, grants to 20 women-owned. How do you find grants for small businesses? You can find small business grants through the federal or state government, nonprofit organizations, private. Information on Grant: The Kitty Fund makes small micro investments in Moms who are running employer-based small businesses with two or more employees. The award. Get funding for your project, business, or organization. Find grants for services like arts, recreation, and youth programs. Go to your local Small Business Administration (SBA) office and ask them for specific help. Start a GoFund me page. Form a partnership with. How to Secure Startup Grants for Nonprofits · 1. Private foundations. Private foundations are one of the best grant funding sources for new nonprofit. Startups can receive up to $2 million from NSF for early-stage research and development; NSF takes no equity in the companies it funds. Submit a project. Active Programs THE CDFRG Program provides relief grants up to $, to small agricultural businesses that experienced a decline in annual gross receipts. Angel Tax Credit provides a 25% tax credit to investors or investment funds that make equity investments in startup companies focused on high technology, new. The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are highly competitive programs that encourage domestic. The funding provides resources for education, training, and advising small and minority business enterprises in their recovery from the effects of the COVID A business grant is a sum of money given to a business in order to help them further their business. They're usually distributed by governments. SBA-Backed Funding. At a federal level, the Small Business Administration (SBA) provides loan guarantees to local banks to make it easier for small businesses. 1. Friends and Family · 2. Small Business Loans · 3. Trade Equity or Services · 4. Bootstrapping · 5. Incubator or Accelerator · 6. Crowdfunding · 7. Small Business. Michigan Rise supports entrepreneurs and technology startups across Michigan through capital support, coaching, assistance with grant funding and more. Funding. What Is a Small-Business Grant? A small-business grant is an award, usually financial, given by one entity (typically a company, foundation, or government) to a. Biz-M-Power Crowdfunding Program (MGCC): The Biz-M-Power crowdfunding matching grant program offers small businesses in Massachusetts financial assistance with.

Maintenance Of Solar Energy

Solar panels are designed to be very durable and resilient. There is plenty of evidence already to show that solar panels can last 30 years and beyond. The bulk of solar panel maintenance is an occasional light cleaning to remove dirt, leaves, or any objects that may block the sun's rays from reaching the solar. The best thing you can do to maintain your solar system is to monitor its production so you can quickly identify and address issues, should they arise. Solar panel maintenance includes regular check ups and servicing to ensure that everything with your panels is running smoothly. This can include addressing any. The short answer is yes, they do. Solar panel systems aren't as high maintenance as other energy systems since they have so few moving parts. Many common solar maintenance issues should be covered by an installer's workmanship warranty or a manufacturer's equipment warranty. In this article, we'll list a few tips for solar panel maintenance and solar panel cleaning. Investing in high-quality solar panels can save you money in the. In this blog post, we will explore the importance of regular solar field maintenance and how it can ensure the optimal performance and longevity of solar. Solar panel systems generally require little maintenance. However, they can still break down, just like all other technical or electronic equipment. Solar panels are designed to be very durable and resilient. There is plenty of evidence already to show that solar panels can last 30 years and beyond. The bulk of solar panel maintenance is an occasional light cleaning to remove dirt, leaves, or any objects that may block the sun's rays from reaching the solar. The best thing you can do to maintain your solar system is to monitor its production so you can quickly identify and address issues, should they arise. Solar panel maintenance includes regular check ups and servicing to ensure that everything with your panels is running smoothly. This can include addressing any. The short answer is yes, they do. Solar panel systems aren't as high maintenance as other energy systems since they have so few moving parts. Many common solar maintenance issues should be covered by an installer's workmanship warranty or a manufacturer's equipment warranty. In this article, we'll list a few tips for solar panel maintenance and solar panel cleaning. Investing in high-quality solar panels can save you money in the. In this blog post, we will explore the importance of regular solar field maintenance and how it can ensure the optimal performance and longevity of solar. Solar panel systems generally require little maintenance. However, they can still break down, just like all other technical or electronic equipment.

Freedom Solar can maintain, repair and upgrade any system for maximum energy production and efficiency. Most solar systems will stay clean by normal rainfall washing the panels. Consider annual washing only if your panels are not tilted. What should a Solar Preventative Maintenance and Monitoring Plan include? · 1. Make a schedule for periodic site walks/inspections. · 2. Create documentation. Solar panel maintenance includes regular check ups and servicing to ensure that everything with your panels is running smoothly. This can include addressing any. Solar panel maintenance will refer to things like cleaning dust or snow off your panels—routine things to maintain the health and productivity of your system. If you don't get enough rain or there's a dry season where you live, you should clean your solar panels manually using a garden hose or pressure washer. You can. Here's all you need to know about solar panel maintenance and maintenance packages to ensure that your panels will produce as much power as possible for as. Regular maintenance · cleaning the solar panels · clearing the area around and under the panels · testing electrical components · inspecting cables, isolator. What should a Solar Preventative Maintenance and Monitoring Plan include? · 1. Make a schedule for periodic site walks/inspections. · 2. Create documentation. Real-time solar monitoring. Optimize your system performance with Palmetto Protect. Coverage options include active professional monitoring, exclusive service. There are a few ways you can ensure you're taking good care of your solar panels. This guide breaks down each of the care methods into easy-to-follow steps. Your solar panels should work efficiently without a yearly service. You shouldn't need to pay extra costs for maintenance packages to keep them running well. After solar energy arrays are installed, they must undergo operations and maintenance (O&M) to function properly and meet energy production targets over the. Your solar panels should work efficiently without a yearly service. You shouldn't need to pay extra costs for maintenance packages to keep them running well. Thanks to our Solar PV Service & Maintenance packages, we can ensure your panels remain in full working order for years and years – even if we've not installed. Regular maintenance · cleaning the solar panels · clearing the area around and under the panels · testing electrical components · inspecting cables, isolator. Just as it's important to maintain your heating and cooling systems in your home, your solar energy system requires regular maintenance — both to make sure. If you don't get enough rain or there's a dry season where you live, you should clean your solar panels manually using a garden hose or pressure washer. You can. In , the cost of maintenance for solar panels averages between $ and $ annually, with a standard rate of around $ for comprehensive upkeep. Unlike many other home appliances, solar panels are designed to be durable and require little to no maintenance over their lifespan. With proper installation.

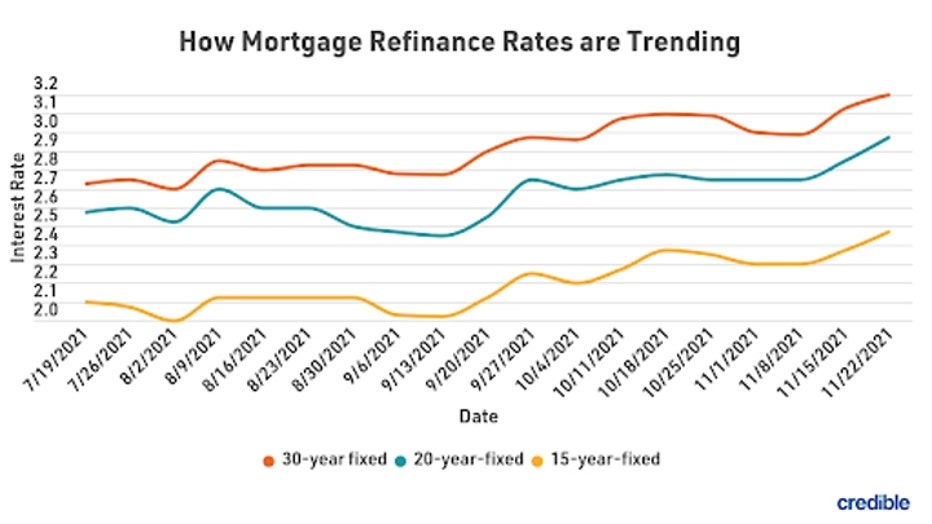

How To Cash Out Home Equity

With a fixed-rate cash-out refinance, you know exactly what your rate will be and what you will pay each month. The best option for you depends on your. There are three ways to leverage your home's equity: home equity loans, home equity lines of credit and a cash-out refinance loan. Refinance. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value. It's calculated by subtracting the outstanding mortgage balance from the home's current market value. As you repay your mortgage or as your home appreciates. The answer is a 3-parter: home equity loans, HELOCs, and cash-out refinances. Each of these financial tools has its own set of guidelines, requirements. Home equity loans, HELOCs and cash-out refinancing all serve the same basic purpose — to secure funding for major expenses. Like any other mortgage loan, a borrower needs to meet certain criteria set by their lender to qualify for a cash-out refinance. Lenders set a home equity. loanDepot is a direct mortgage lender offering cash out refinance programs with low rates & fast approvals. Visit our site & get your rate. A cash out refinance option offers two big benefits. It allows you to turn your home's equity into cash plus lock in a lower interest rate on your mortgage. With a fixed-rate cash-out refinance, you know exactly what your rate will be and what you will pay each month. The best option for you depends on your. There are three ways to leverage your home's equity: home equity loans, home equity lines of credit and a cash-out refinance loan. Refinance. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value. It's calculated by subtracting the outstanding mortgage balance from the home's current market value. As you repay your mortgage or as your home appreciates. The answer is a 3-parter: home equity loans, HELOCs, and cash-out refinances. Each of these financial tools has its own set of guidelines, requirements. Home equity loans, HELOCs and cash-out refinancing all serve the same basic purpose — to secure funding for major expenses. Like any other mortgage loan, a borrower needs to meet certain criteria set by their lender to qualify for a cash-out refinance. Lenders set a home equity. loanDepot is a direct mortgage lender offering cash out refinance programs with low rates & fast approvals. Visit our site & get your rate. A cash out refinance option offers two big benefits. It allows you to turn your home's equity into cash plus lock in a lower interest rate on your mortgage.

Mutual of Omaha Mortgage offers two financing options on your mortgage to be able to help pay off debt: a cash-out refinance and home equity loan. Are you looking to get cash out of your home but aren't sure of the differences between a cash-out refinance vs. a home equity loan? A cash-out refinance is just one way to borrow against your home's available equity. A home equity line of credit, or HELOC, is another popular option. What's. A cash-out refinance is a new mortgage (replacing your old one) that lets you borrow extra money as part of the mortgage. A fixed home equity loan is a loan. Your loan balance increases as you withdraw money from the line of credit, and then decreases as you make monthly payments. Reverse mortgage. A homeowner who is. This home equity line of credit, or HELOC, is often referred to as a “second mortgage.” While the two options share certain characteristics — both leverage your. A cash-out refinance takes the equity you have built up in your home, replaces your current home loan with a new mortgage, and when you close on the loan, you. Cashing Out Equity On Home · You can borrow up to 80% of the value of your property, minus what you still owe on it, if you can provide a stated purpose (no. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. A cash-out refinance allows you to get cash out of your home using your home's equity. You can use this cash to make repairs or remodel your home. Visit to compare mortgage cash out refinancing vs a home equity loan or line of credit and see which financing options is best for you, from TD Bank. Most lenders require you to have at least 20% equity — or a loan-to-value ratio (LTV) of 80% or less — to be eligible for cash-out refinancing or a home equity. This cash-out refinancing vs. home equity loan comparison covers how each loan works for your interest rate, monthly payment, and how to use your equity. Cash-Out Refinancing works by allowing you to turn part (or all, in some instances) of your home's equity into liquid cash. Your home equity is your home's. Unlike a home equity loan or home equity line of credit (HELOC), with a cash out refinance, you withdraw cash one time and repay through your regular monthly. See the differences between how a HELOC, Home Equity Loan, or a cash-out refinance utilizes your home's equity. Find out more. Refinancing an investment. A cash-out refinance involves using the equity built up in your home to replace your current home loan with a new mortgage and when the new loan closes, you. The repayment period for equity loans and refinances are flexible and can be extended as long as 30 years. With a HELOC, you can pay off the amount owed at any. Equity in your home: If you want to pursue a cash-out refinance, you need to have equity in your home. · High or improved credit score: For a cash-out refinance.

Best Rental Property Refinance Rates

Ready to get your investment property loan? · Flexible Financing Options for Your Rental Properties · Loan Features · Get the Best Investment Property Mortgage. Additionally, the current national average year fixed refinance rate remained stable at %. The current national average 5-year ARM refinance rate is. Compare current investment property mortgage rates using the free, customized rate shopping tool from NerdWallet. Thinking of buying an investment property in NC? Let Coastal Credit Union help you bank better with our Investment Property Loans. View our rates online. Investment property loans are used for the purchase of second homes and investment properties, including one- to four-unit residential properties and vacation. The three best that we've found are Visio, New Silver, and Kiavi. Better yet, have a specialist comparison shop to find you the best interest rate available. Mortgage interest rates for single-family investment properties are typically bps to bps higher than conventional mortgages. @NIcholas Hamel Lowest I've seen on purchase is % with 20% down, no points, $ lender fees with Stifel. I think refi is higher however. Mortgage Rates for Primary or Secondary Residences · Fixed-Rate First Mortgage * as low as % (% APR) · Adjustable-Rate Mortgage ** as low as % . Ready to get your investment property loan? · Flexible Financing Options for Your Rental Properties · Loan Features · Get the Best Investment Property Mortgage. Additionally, the current national average year fixed refinance rate remained stable at %. The current national average 5-year ARM refinance rate is. Compare current investment property mortgage rates using the free, customized rate shopping tool from NerdWallet. Thinking of buying an investment property in NC? Let Coastal Credit Union help you bank better with our Investment Property Loans. View our rates online. Investment property loans are used for the purchase of second homes and investment properties, including one- to four-unit residential properties and vacation. The three best that we've found are Visio, New Silver, and Kiavi. Better yet, have a specialist comparison shop to find you the best interest rate available. Mortgage interest rates for single-family investment properties are typically bps to bps higher than conventional mortgages. @NIcholas Hamel Lowest I've seen on purchase is % with 20% down, no points, $ lender fees with Stifel. I think refi is higher however. Mortgage Rates for Primary or Secondary Residences · Fixed-Rate First Mortgage * as low as % (% APR) · Adjustable-Rate Mortgage ** as low as % .

Fannie Mae guidelines only require 15% equity to refinance an investment home, but most lenders default to a 20% minimum. If you own an underwater mortgage on. Start the process by looking at investment property refinance rates to be sure they represent a savings over your current rates. Get started investing in real estate when you buy investment property or rental housing with a mortgage We can discuss your loan options and rates and find a. INDIANA INVESTMENT PROPERTY LOANS · esc-easyfix. Program Terms. Rates starting at %; Up to 90% LTC / 70% LTV; 48 Hour Closes! · esc-easyrent. Program Terms. Investment property mortgage rates are generally to percent higher than the mortgage rates on conventional loans for residential properties. That's. Interest rates for investment property mortgages tend to be % to % higher than those of primary residence mortgages. Why? Because when push comes to. rate. Living Rent Free With Investment Properties. One way new investors approach buying investment properties is to leverage the better loan rates that. Todays Mortgage Rates For Tuesday 27, August · % · % · % · % · % · Investment Home Mortgage Rates. Lenders often ask investors refinancing a rental property to hold six months of mortgage payments in a reserve or escrow account. Having cash reserves lets the. A normal loan-to-value ratio on an investment property refinance is about 75%, meaning that you should have at least 25% equity in your investment property. Based on that average, an investment property borrower with excellent credit who qualifies for the most competitive investment property rate might receive %. Best Investment Property Loans · Best for Low Down Payment: Quicken Loans (Rocket Mortgage) · Best for Veterans: Veterans United Home Loans · Best for Commercial. Non owner occupied investment properties have at least a 1 if not % premium over primary residence. The key is to buy a multi unit and. To qualify for a mortgage for rental property, your DTI should ideally fall between 36% and 45%. In many cases, borrowers can count 75% of their potential. Credit score- the higher the best. + gets best pricing for investment property loans with most lenders. 2. Loan to value ratio: The higher the loan to. Looking to buy an investment property? We offer fixed & adjustable-rate investment property and second home loan options. Learn more and get prequalified. You also need to have a good debt-to-income ratio and proof of a steady income. Investment property loans may also have a slightly higher interest rate compared. Investment property mortgage rates are higher than those for residential loans because they are a greater risk for the lender. Generally, this means that they. If you're refinancing a whole portfolio of rental properties, this requirement will be even higher — at least , according to Fannie Mae's guidelines. Lower. rates, fees, and lower loan-to-value ratios. Obtaining a cash-out refinance rental property loan can be a good way to raise capital for additional investments.

Easiest Trading Platform To Use

Yes, I've been using Saxo's online trading platform for around ten years now and it's evolved nicely over the years. The core functionality remains consistently. Easy Trade Platform helps to manage orders and online trading platforms by traders and improve connectivity to exchanges and brokers. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. Intuitive, easy-to-use platforms. Multi-asset platform. eToro offers 5,+ financial instruments across various classes, such as stocks, crypto. Help is needed so I can start investing again. The app is really great easy to use and fantastic all round when it does work. more. Developer Response. What makes it great: Interactive Brokers is powerful enough for Wall Street investors managing institutional investment accounts. As an individual trader using. This is by far the best And safest way to use your money And i think VOO would be a decent place to do it. I'd go with Ameritrade if i were you. OANDA - Best Forex Trading Platform For Beginners We've put OANDA to the test, and it didn't disappoint. They've mastered the global forex game with over eToro is great. It's an easy to use, low cost, trading platform, with a huge range of investment options. It's crazy popular, with a huge community you can. Yes, I've been using Saxo's online trading platform for around ten years now and it's evolved nicely over the years. The core functionality remains consistently. Easy Trade Platform helps to manage orders and online trading platforms by traders and improve connectivity to exchanges and brokers. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. Intuitive, easy-to-use platforms. Multi-asset platform. eToro offers 5,+ financial instruments across various classes, such as stocks, crypto. Help is needed so I can start investing again. The app is really great easy to use and fantastic all round when it does work. more. Developer Response. What makes it great: Interactive Brokers is powerful enough for Wall Street investors managing institutional investment accounts. As an individual trader using. This is by far the best And safest way to use your money And i think VOO would be a decent place to do it. I'd go with Ameritrade if i were you. OANDA - Best Forex Trading Platform For Beginners We've put OANDA to the test, and it didn't disappoint. They've mastered the global forex game with over eToro is great. It's an easy to use, low cost, trading platform, with a huge range of investment options. It's crazy popular, with a huge community you can.

Download the R MobileTrader app and start using a simple and comfortable trading platform today! R MobileTrader is a fully-featured mobile trading station. IBKR offers desktop, mobile and online trading platforms with no platform fees. See which platform is best for your trading skills and investing strategies! SoFi Invest refers to the two investment and trading platforms operated by Social Finance, Inc. use of our sites and assist in our marketing efforts. We share. Invest your way, commission-free Build your own portfolio with thousands of stocks, ETFs, and options — all on our powerful, yet easy-to-use trading platform. Charles Schwab; Fidelity Investments; Interactive Brokers; Ally Invest; E-Trade Financial; Firstrade; Firstrade; Webull; Merrill Edge; SoFi Active Investing. We're #1 for Broker and Trust Score. See for yourself using our easy-to-use trading platform, customizable indicators, and how we source our prices. Regardless, Webull remains one of the best, and most cost-friendly, trading platforms you can come across. And on top of all the free features mentioned above. Best for Beginners: Robinhood Robinhood is the best free online stock broker for beginners because it's the easiest to use. Its mobile app is streamlined and. Intuitive, easy-to-use platforms. Multi-asset platform. eToro offers 5,+ financial instruments across various classes, such as stocks, crypto. 1. Charles Schwab Charles Schwab is an established name in the stock market and investing world. The Charles Schwab app allows you to take. The eToro app has all the tools you need to become an investor. Start investing today. exchanges with eToro's easy to use platform. eToro is not just a. The obvious drawback with IG is that it only offers forex trading to US-based investors. Thus, leaving out stocks, bonds, commodities, ETFs, and many other. Start investing with no minimums on this easy-to-use mobile app in both Canadian and U.S. currency. Invest in: Stocks, TD Exchange Traded Funds (ETFs). My second pick for best options trading app is Power E-Trade. E-Trade is one of the brokerage platforms I frequently use for stock trades. It's far from the. Here at CAPEX, we offer our users two trading platforms that are both recognized for being easy to use and highly professional. Our platforms are easy on. Invest your way, commission-free Build your own portfolio with thousands of stocks, ETFs, and options — all on our powerful, yet easy-to-use trading platform. Invest with the multi-asset platform that revolutionized trading. Join millions of investors worldwide who share their ideas and strategies in a community. Take full control over each trade in just a few clicks, using the range of helpful features in our easy-to-use deal ticket: Get an instant overview of. Is thinkorswim the only platform I can use to trade? No. While thinkorswim® offers a full suite of powerful trading platforms (desktop, web, and mobile).

Do Business Cards Affect Credit Score

A Business credit card can impact your personal credit score, depending on the card issuer's reporting practices. If a business card issuer reports business. For personal credit cards, credit card companies report to Equifax, Experian, and TransUnion. These are the consumer credit bureaus that create your personal. The short answer is yes — corporate credit cards may affect business credit scores. The activity of both corporate credit cards and small business credit cards. Does a business credit card affect my personal credit score? A personal guaranty is required for most business credit cards, so defaulting on a business credit. Such a transaction has no impact on the credit score what-so-ever, because your outstanding credit balance and available limit practically. U.S. Bank Business Triple Cash Rewards World Elite Mastercard: Overall best credit card that doesn't report to personal credit bureaus with a month 0% APR. When you apply for a business credit card, you'll receive a hard inquiry on your personal credit, which may temporarily lower your credit score by a few points. If you're an authorized user of a corporate credit card with a large company, using the card is unlikely to have much effect on your personal credit. Bank of America is one of the few business credit card issuers that won't report account activity to any consumer credit bureau. That makes it one of the safest. A Business credit card can impact your personal credit score, depending on the card issuer's reporting practices. If a business card issuer reports business. For personal credit cards, credit card companies report to Equifax, Experian, and TransUnion. These are the consumer credit bureaus that create your personal. The short answer is yes — corporate credit cards may affect business credit scores. The activity of both corporate credit cards and small business credit cards. Does a business credit card affect my personal credit score? A personal guaranty is required for most business credit cards, so defaulting on a business credit. Such a transaction has no impact on the credit score what-so-ever, because your outstanding credit balance and available limit practically. U.S. Bank Business Triple Cash Rewards World Elite Mastercard: Overall best credit card that doesn't report to personal credit bureaus with a month 0% APR. When you apply for a business credit card, you'll receive a hard inquiry on your personal credit, which may temporarily lower your credit score by a few points. If you're an authorized user of a corporate credit card with a large company, using the card is unlikely to have much effect on your personal credit. Bank of America is one of the few business credit card issuers that won't report account activity to any consumer credit bureau. That makes it one of the safest.

Credit Inquiry: When you apply for a business credit card, the card issuer might do a hard inquiry on your personal credit report, especially if a personal. Authorized users of small business credit cards could also see their credit affected by its activity. If the credit account is managed responsibly, then all. This inquiry can have a temporary impact on your credit score. However, the impact is usually minor, and as you make on-time payments, it can have a positive. Be aware that business credit card issuers could report late payments to the three major consumer credit bureaus, which can affect your personal credit. But as. With a few exceptions, Business card accounts do not appear on your personal credit reports, and therefore have no role in calculation of your credit scores. A business credit score that indicates low risk may help your business qualify for better rates on credit cards, loans and lines of credit, and can increase its. Small Business credit cards are backed by personal credit, however they are not included on your credit report as long as your credit card is in good standing. Another is that some business credit card issuers will report negative information to the consumer credit bureaus, meaning that if you get behind on payments. Corporate credit card issuers might also look at a company's business credit score, recent audited financial statements, tax info, and more. The Pros & Cons. High credit usage on your business credit card could impact your personal credit. Towers showing the three consumer credit bureaus are: TransUnion, Equifax, and. Business credit cards can affect personal credit scores if the issuer reports your activities to the consumer credit bureaus. Yes, business credit cards can affect a business credit score. Similar to personal credit cards, the usage and management of business credit cards can impact. U.S. Bank Business Triple Cash Rewards World Elite Mastercard: Overall best credit card that doesn't report to personal credit bureaus with a month 0% APR. Yes, it does have an impact on your credit score. It is important to understand that when it comes to business credit cards you are responsible for the debt as. Business credit card payment history can significantly impact personal credit scores. When a business owner uses a business credit card, the payment history is. Business credit card payment history can significantly impact personal credit scores. When a business owner uses a business credit card, the payment history is. How does a corporate credit card impact your credit score? The responsible use of corporate credit cards will positively affect the business's credit score. Do business credit cards affect personal credit? Most small business credit cards affect personal credit in a few ways. First, card issuers will (usually). Business credit cards can affect personal credit scores if the issuer reports your activities to the consumer credit bureaus. However, it is very rare that your business scores and ratings will have a great impact on your personal credit scores and opportunities. If you are asked for.

Ew Stock Forecast

.png)

Based on the share price being below its 5, 20 & 50 day exponential moving averages, the current trend is considered strongly bearish and EW is experiencing. The average one-year price target for Edwards Lifesciences Corporation is $ The forecasts range from a low of $ to a high of $ A stock's. View Edwards Lifesciences Corporation EW stock quote prices, financial information, real-time forecasts, and company news from CNN. Latest After-Hours Trades ->. After Hours Time (ET). After Hours Price. After Hours Share Volume. Edwards Lifesciences Corporation ($EW) Stock Forecast: Down % Today. Rewards · Trading at 10% below our estimate of its fair value · Earnings are forecast to grow % per year · Earnings grew by % over the past year · Trading at. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Edwards Lifesciences (EW) stock price prediction is USD. The Edwards Lifesciences stock forecast is USD for August Edwards Lifesciences (EW) has a Smart Score of 8 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Based on the share price being below its 5, 20 & 50 day exponential moving averages, the current trend is considered strongly bearish and EW is experiencing. The average one-year price target for Edwards Lifesciences Corporation is $ The forecasts range from a low of $ to a high of $ A stock's. View Edwards Lifesciences Corporation EW stock quote prices, financial information, real-time forecasts, and company news from CNN. Latest After-Hours Trades ->. After Hours Time (ET). After Hours Price. After Hours Share Volume. Edwards Lifesciences Corporation ($EW) Stock Forecast: Down % Today. Rewards · Trading at 10% below our estimate of its fair value · Earnings are forecast to grow % per year · Earnings grew by % over the past year · Trading at. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Edwards Lifesciences (EW) stock price prediction is USD. The Edwards Lifesciences stock forecast is USD for August Edwards Lifesciences (EW) has a Smart Score of 8 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund.

EW's current price target is $ Learn why top analysts are making this stock forecast for Edwards Lifesciences at MarketBeat. See the latest Edwards Lifesciences Corp stock price (EW:XNYS), related news, valuation, dividends and more to help you make your investing decisions. Edwards Lifesciences Stock Forecast, EW stock price prediction. Price target in 14 days: USD. The best long-term & short-term Edwards Lifesciences. Over the last 12 months, its price fell by percent. Looking ahead, we forecast Edwards Lifesciences to be priced at by the end of this quarter and at. Based on short-term price targets offered by 24 analysts, the average price target for Edwards Lifesciences comes to $ The forecasts range from a low of. Assess the Edwards Lifesciences stock price estimates. View analyst opinion as to whether the stock is a strong buy, strong sell or hold, based on analyst Edwards Lifesciences Corp has a consensus price target of $ based on the ratings of 26 analysts. The high is $ issued by Jefferies on July 25, The Edwards Lifesciences stock forecast for tomorrow is $ , which would represent a % loss compared to the current price. In the next week, the price. According to 20 analysts, the average rating for EW stock is "Buy." The month stock price forecast is $, which is an increase of % from the latest. Edwards Lifesciences Corp. analyst ratings, historical stock prices, earnings estimates & actuals. EW updated stock price target summary. The 19 analysts with month price forecasts for EW stock have an average target of , with a low estimate of 70 and a high estimate of The average. On average, analysts forecast that EW's EPS will be $ for , with the lowest EPS forecast at $, and the highest EPS forecast at $ In , EW's. According to analysts, EW price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. Nasdaq Analyst Research provides analyst research for ratings consensus and a summary of stock price targets. Analysts evaluate the stock's expected. Get Edwards Lifesciences Corp (EW:NYSE) real-time stock quotes, news, price and financial information from CNBC. The 90 analysts offering price forecasts for Edwards Lifesciences have a median target of , with a high estimate of and a low estimate of The. Zacks' proprietary data indicates that Edwards Lifesciences Corporation is currently rated as a Zacks Rank 3 and we are expecting an inline return from the EW. Edwards Lifesciences Stock (NYSE: EW) stock price, news, charts, stock research, profile. Edwards Lifesciences is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on. The current price of EW is USD — it has decreased by −% in the past 24 hours. Watch Edwards Lifesciences Corporation stock price performance more.

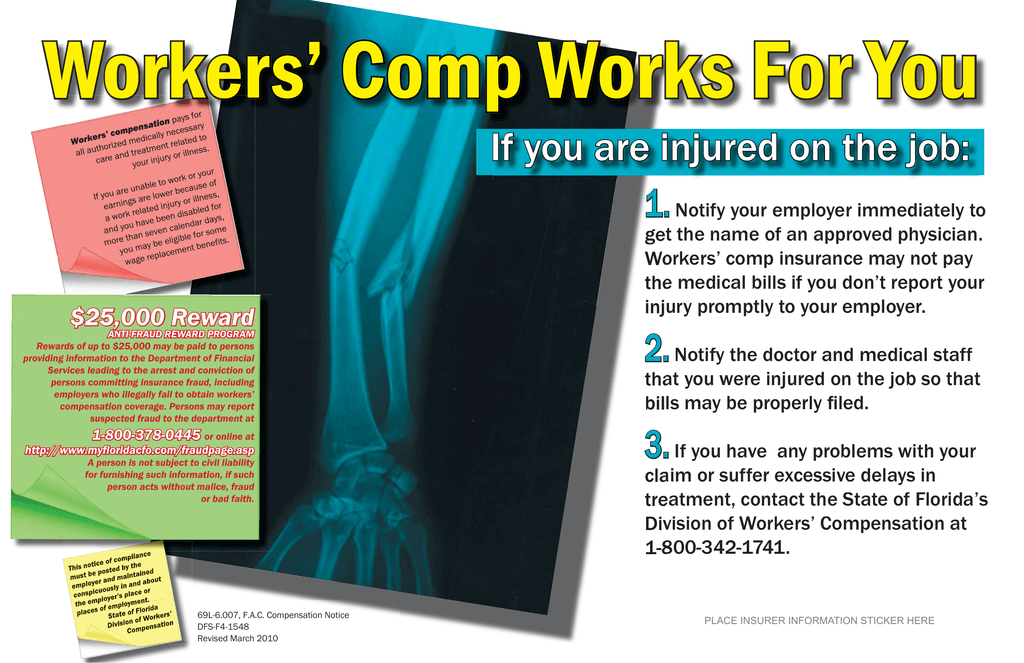

Workers Compensation Carriers In Florida

Get affordable workers' compensation for your Florida small business in 5 minutes flat. Everything's online. Everything's easy. Nuclear Weapons Workers Medical Providers · Coal Mine Workers Medical Minnesota Avenue, N.E.. Washington, DC () FLORIDA. From Miami and Orlando to Tampa, Sarasota and everywhere in between, AmTrust is a one-stop shop for Florida workers' compensation insurance. Workers Compensation Insurance without limits. View your rates with ease, get approved within minutes, and get your certificate effortlessly. About Us. Augustyniak Insurance is an independent insurance agency located in Jacksonville, Florida. Give us a call, stop by, or request a quote online to find. According to Florida State law, in most cases, you are required to have workers' compensation insurance if you have employees. Florida workers' compensation insurance can help protect your small business from workplace injury costs. Get a free quote and buy instant coverage. Here are the best workers' comp insurance providers in Florida: 1. The Hartford With more than years of experience, The Hartford is selected among the. Florida workers' compensation law says that most businesses with four or more employees need workers' comp coverage. Get affordable workers' compensation for your Florida small business in 5 minutes flat. Everything's online. Everything's easy. Nuclear Weapons Workers Medical Providers · Coal Mine Workers Medical Minnesota Avenue, N.E.. Washington, DC () FLORIDA. From Miami and Orlando to Tampa, Sarasota and everywhere in between, AmTrust is a one-stop shop for Florida workers' compensation insurance. Workers Compensation Insurance without limits. View your rates with ease, get approved within minutes, and get your certificate effortlessly. About Us. Augustyniak Insurance is an independent insurance agency located in Jacksonville, Florida. Give us a call, stop by, or request a quote online to find. According to Florida State law, in most cases, you are required to have workers' compensation insurance if you have employees. Florida workers' compensation insurance can help protect your small business from workplace injury costs. Get a free quote and buy instant coverage. Here are the best workers' comp insurance providers in Florida: 1. The Hartford With more than years of experience, The Hartford is selected among the. Florida workers' compensation law says that most businesses with four or more employees need workers' comp coverage.

Summit, know the people who know workers' comp. PO Box Lakeland, FL phone LinkedIn. Legal | Contact Us | Report a problem with this. Tivly offers a guide to Workers' Compensation Insurance in Florida. Learn more about Florida workers' comp requirements and get a free quote today. (5) “Carrier” means any person or fund authorized under s. to insure under this chapter and includes a self-insurer, and a commercial self-insurance fund. Your Complete Resource for Work Comp Insurance, Premium Recovery, and Claims Management WCS is a forensic, niche company specializing in reducing workers'. There are more than insurers offering workers' compensation insurance in the state of Florida. In Florida, the largest workers' compensation insurer is a. Worker's Compensation insurance policies are provided by private insurers; laws and requirements vary by state. In Florida, any employer with four or more. Coverage includes medical expenses and a portion of lost wages for employees who become injured or ill on the job. Workers comp insurance also covers employee. Since our beginning in , workers' compensation insurance has always been one of the most important benefits FUBA provided to small businesses in Florida. Provider Sample Forms Certificates of Insurance. AGENCY All Links. © - Florida Workers' Compensation Joint Underwriting Association, Inc. -. 1, , Florida issued a mandate that all workers compensation medical benefits were to be delivered in an approved managed care arrangement (MCA). Since that. We assist injured workers, employers, health care providers, and insurers in following the Florida workers' compensation rules and laws. Work Comp Associates offers personalized, professional workers compensation solutions to small and mid-sized businesses throughout the state of Florida. . (FWCIGA) is to implement Florida Statute Sections – and to provide a mechanism for the payment of covered claims, to avoid excessive delay in. Florida's workers' compensation insurance covers almost all on-the-job injuries. Most employers in Florida must carry workers' compensation insurance. All Florida contractors by law are required to have Work Comp. The main way contractors get around this requirement is by becoming a corporation. CopperPoint, Erie, Everest Insurance, Great American, ICW, Pinnacol Assurance and Texas Mutual are the best workers' compensation insurance companies in our. Florida worker's compensation Insurance, policies and quotes by Blue Sky Insurance agency in Boca Raton. Meet Florida's worker's comp insurance laws be. The average premium in Florida is about $ for every $ in payroll. According to one insurer, however, workers' comp insurance in Florida costs about Work Comp Associates, Inc. is the leading source of Florida workers compensation information and resources. As the best in class Insurance Agency in Florida. Birkshire Hathaway Guard Berkshire Hathaway GUARD is currently licensed to sell workers' compensation insurance in nearly all states. Great insurance company.

Business Money Market Interest Rates

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

Use your excess cash to grow your business savings. Our business money market account is a great way to help your business save, whether you're building your. Earn more on what you save, thanks to an attractive interest rate. Plus, enjoy the flexibility to access your funds when you need them. Premier Business Money Market ; Tier 1 ($1 - $24,), % ; Tier 2 ($25, - $49,), % ; Tier 3 ($50, - $99,), % ; Tier 4 ($, -. Business Premium Relationship Money Market (PRMM) ; $1, – $49, · %, % ; $50, – $99, · %, % ; $, – $, · %, %. Give an added boost to your business's savings · Competitive, tiered rates on Money Market and Premium Money Market Accounts · Make unlimited deposits · Start with. account, you'll earn more interest as your balance grows. Earn competitive interest rates on your surplus business savings. Enjoy immediate access to your money. Competitive interest rates · Earn interest on any balance amount · $ minimum daily balance to waive $5 monthly maintenance fee · $25 minimum opening deposit. Wells Fargo's Business Market Rate savings account combines liquidity with competitive rates to suit the growing balances of your business. Truist Business Money Market · % APY On new accounts · 10 Monthly deposited items · $5, Monthly cash deposits · $10 or $0 Monthly maintenance fee. Use your excess cash to grow your business savings. Our business money market account is a great way to help your business save, whether you're building your. Earn more on what you save, thanks to an attractive interest rate. Plus, enjoy the flexibility to access your funds when you need them. Premier Business Money Market ; Tier 1 ($1 - $24,), % ; Tier 2 ($25, - $49,), % ; Tier 3 ($50, - $99,), % ; Tier 4 ($, -. Business Premium Relationship Money Market (PRMM) ; $1, – $49, · %, % ; $50, – $99, · %, % ; $, – $, · %, %. Give an added boost to your business's savings · Competitive, tiered rates on Money Market and Premium Money Market Accounts · Make unlimited deposits · Start with. account, you'll earn more interest as your balance grows. Earn competitive interest rates on your surplus business savings. Enjoy immediate access to your money. Competitive interest rates · Earn interest on any balance amount · $ minimum daily balance to waive $5 monthly maintenance fee · $25 minimum opening deposit. Wells Fargo's Business Market Rate savings account combines liquidity with competitive rates to suit the growing balances of your business. Truist Business Money Market · % APY On new accounts · 10 Monthly deposited items · $5, Monthly cash deposits · $10 or $0 Monthly maintenance fee.

Business Money Market Rates ; %, %, % ; %, %, %. Business Money Market · Interest compounded daily · Interest earned on all collected balances · No monthly fee with a minimum daily balance of $5, · 25 free. Savings Account Options ; Open with as little as$ ; APY (Annual Percentage Yield)% with a daily balance of $5,, or below. % with a daily balance. No monthly maintenance fee on average monthly collected balances of $10, or more Otherwise, it is $10 a month. Tiered interest rates to help you earn more as. First Internet Bank: Money Market Savings - % APY · Live Oak Bank: Business Savings Account - % APY · Prime Alliance Bank: Business Money Market - %. Business Money Market Accounts · Ideal for balance of $10, or higher · Competitive, tiered interest rates · Quickly access business funds when you need them. Get a competitive interest rate · Keep a low minimum balance · Easily access savings through ATMs · Enjoy secure online access to check balances and transfer funds. Features & Benefits With tiered interest rates, the more you save, the more you can earn. Put your business deposits to work with a Business Money Market. A business money market account will typically earn a higher interest rate than a business savings account because the money is invested. With a money market account, you earn interest on the money deposited into the account, just like how a savings account works. When opening the account, a. The bonus interest rate will be % when your account balance tier is $25, to $2,, If the account balance falls below $25, or goes above. A business money market account is a type of savings account for business owners that offers tiered rates and compound interest. No monthly maintenance fee on average monthly collected balances of $10, or more Otherwise, it is $10 a month. Tiered interest rates to help you earn more as. Savings Account Options ; Open with as little as$ ; APY (Annual Percentage Yield)% with a daily balance of $5,, or below. % with a daily balance. Earn % APY to maximize your savings. Whether you're saving for a planned purchase or need reserves for an unexpected event, our business money market. Business Premium Relationship Money Market (PRMM) ; $1, – $49, · %, % ; $50, – $99, · %, % ; $, – $, · %, %. Experience interest rates that build as your balance builds, while maintaining your easy access to cash. Associated Bank offers a selection of business. We're a bank in the business of helping yours earn interest. Earn % APY. A flexible. Details. Details. Ideal for sole proprietors and small to mid-sized businesses that want to earn a guaranteed interest rate. Withdraw and deposit funds in any. Frost Money Market Account ; $ - $24, % ; $25, - $49, % ; $50, - $99, % ; $, - $, % ; $, -.

How To Make A Joint Checking Account

:max_bytes(150000):strip_icc()/should-you-have-joint-or-separate-bank-accounts-1289664-final-5bd08bd946e0fb0026ee9838-5bec6d0bc9e77c0051fcd280.png)

A joint bank account generally works like any other checking or savings account. The difference is that two people—married or unmarried partners, parent and. A joint bank account is just like any other bank account, except two or more people have access to the money. For couples, this means you and your partner can. Provide the basics. Answer a few questions on our website or mobile app. · Add a joint account holder. We'll send your partner an application to fill out. · Set. You can open a joint account with one other person. We'll deposit to the joint account any cheques that are payable to both of you or just one of you. You will need to visit a CIBC Banking Centre, or speak to one of our representatives through telephone banking, to add your co-applicant during the account. A joint checking account is a bank account that has been opened by two or more individuals or entities. These types of accounts are typically opened by close. Select “Open a joint account”; Invite friends and family To open a joint account from your mobile app: Sign in to your account; Tap the menu at the top right. You can open a joint bank account online or over the phone — in this case, you'll need the personal information for each account owner, such as their name, date. A joint account is a bank or brokerage account shared between two or more individuals. Joint accounts are most likely to be used by relatives, couples, or. A joint bank account generally works like any other checking or savings account. The difference is that two people—married or unmarried partners, parent and. A joint bank account is just like any other bank account, except two or more people have access to the money. For couples, this means you and your partner can. Provide the basics. Answer a few questions on our website or mobile app. · Add a joint account holder. We'll send your partner an application to fill out. · Set. You can open a joint account with one other person. We'll deposit to the joint account any cheques that are payable to both of you or just one of you. You will need to visit a CIBC Banking Centre, or speak to one of our representatives through telephone banking, to add your co-applicant during the account. A joint checking account is a bank account that has been opened by two or more individuals or entities. These types of accounts are typically opened by close. Select “Open a joint account”; Invite friends and family To open a joint account from your mobile app: Sign in to your account; Tap the menu at the top right. You can open a joint bank account online or over the phone — in this case, you'll need the personal information for each account owner, such as their name, date. A joint account is a bank or brokerage account shared between two or more individuals. Joint accounts are most likely to be used by relatives, couples, or.

You can add a joint account owner in online banking in just a few steps: Log in to online banking and click into the account for which you want to designate a. Joining bank accounts with your significant other is a procedure your banker can easily explain. Keeping that joint checking account convenient and. As joint owners, each owner has full access to the funds in the account and may make decisions concerning the account, such as signing checks, making deposits. You may do so together online or in a branch. If the minor is under the age of 13 or if you wish to open any other joint account with a minor, you must do so. A joint bank account is a shared bank account between two people. Sharing a bank account makes it possible for either party to deposit and withdraw funds. Opening a joint checking account is very similar to opening an individual checking account. Select "joint account" when you fill out your application. A: A joint account is a checking account shared by more than one person. Each person on the account may add, withdraw or transfer money and has access to. How to Open a Joint Bank Account. If you decide opening a joint account makes sense for your situation, the process is similar to opening an individual account. When you live with someone that you trust and with whom you're in a committed relationship, joint checking can be a good idea. It can make sense to pay shared. Here's more on how to discuss money when your spouse is on another planet, personality-wise. You might get rusty. When couples share a joint bank account, what. make the transfers we need to make into the joint accounts. We do the classic: one joint account and then our separate checking/savings. You should only open a joint account with someone you trust. Your co-holder can carry out the same transactions as you, including purchases, withdrawals and. Truist One Checking makes it easy for you and your partner to manage your money. You can both make deposits, check balances, and more through the app—no matter. To open a joint Rewards Checking account, an eligible Card Member must first apply and be approved for an individual Rewards Checking account. That account. How do I open a joint checking account? Joint checking accounts must be With Early Pay Day, the Bank may make incoming electronic direct deposits. Have an open and honest discussion with your significant other about your spending habits and how you'd like to use the account. What information do I need to open a joint account? 2. What do you need to open a joint bank account? · Passport · Driver's licence · EU identity card · Utility bill · Council tax bill · Mortgage statement or rent. What's a joint account? It's a regular bank account in the name of two or more people with the same account privileges. Anyone, like a spouse, family member. To add a joint owner to an existing Quorum checking or savings account, download and complete a Joint Ownership application here.

1 2 3 4 5