marketingways.ru

News

Financial Institution For Chime

44K subscribers in the chimefinancial community. Chime is a financial technology company, not a bank. Banking services provided by The. View customer complaints of Chime Financial, Inc., BBB helps resolve Please note that Chime is a financial technology company, not a bank, and. Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. that use “banking” terminology that Chime is a financial technology company, not a bank, and banking services are provided by Chime's. Banking Partner(s). Chime. Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members. members of the UC community may have been used in attempts to open unauthorized bank accounts at financial institutions such as Chime and Go2Bank. Some of. Bank accounts with Chime are also FDIC insured up to $, since The Bancorp Bank and Stride Bank are both members of the FDIC. In addition, Chime has. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Chime is not a bank, and Chime customers do not have a customer relationship with its banks. The FDIC bank insurance on Chime accounts does not directly protect. 44K subscribers in the chimefinancial community. Chime is a financial technology company, not a bank. Banking services provided by The. View customer complaints of Chime Financial, Inc., BBB helps resolve Please note that Chime is a financial technology company, not a bank, and. Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. that use “banking” terminology that Chime is a financial technology company, not a bank, and banking services are provided by Chime's. Banking Partner(s). Chime. Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members. members of the UC community may have been used in attempts to open unauthorized bank accounts at financial institutions such as Chime and Go2Bank. Some of. Bank accounts with Chime are also FDIC insured up to $, since The Bancorp Bank and Stride Bank are both members of the FDIC. In addition, Chime has. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Chime is not a bank, and Chime customers do not have a customer relationship with its banks. The FDIC bank insurance on Chime accounts does not directly protect.

members of the UC community may have been used in attempts to open unauthorized bank accounts at financial institutions such as Chime and Go2Bank. Some of. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. *Early access to direct deposit funds depends on the timing of the. Chime is a financial technology company that, with its bank partners, offers online checking and savings accounts as well as a credit-building secured credit. Chime® is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa. All funds in Chime deposit accounts are FDIC-insured through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. Bank accounts with Chime are also FDIC insured up to $, since The Bancorp Bank and Stride Bank are both members of the FDIC. In addition, Chime has. Personal finances. Business finances. Payment. Lending. M1 Finance. Simple. Chime. Oportun. Oportun uses financial data to help you save a little bit every. Loans are issued by The Bancorp Bank, N.A. or Stride Bank, N.A.. Nationwide Multistate Licensing System (“NMLS”) Identification: Chime Capital, LLC – NMLS ID. NEW Online Banking is Here! · Home Loans · Trucking & Heavy Equipment · Commercial Real Estate · Healthcare Banking · Farm Loans · Commercial & Industrial Loans · Bank. Top online banks like Chime include Varo, SoFi, Current, Axos, Capital One, Step, Dave and Fizz. See how these Chime alternatives compare. * Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit. Locating Your Chime Banking Partners · Chime's Headquarters: Chime has its headquarters in San Francisco, California. This address is associated. Chime's headquarters is located at California Street, San Francisco. What is Chime's latest funding round? Chime's latest funding round is Series G - II. Chime is a financial technology company that, with its bank partners, offers online checking and savings accounts as well as a credit-building secured credit. Chime Financial, Inc. is a financial technology company based in San Francisco, CA, offering a range of banking services and products. Chime is a financial technology company that offers digital banking services, including checking accounts, savings accounts, and debit cards. and may be used everywhere Visa debit cards are accepted. Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank. In December Business Insider included Chime as a company anticipating a IPO, stating “The digital bank denied it had immediate plans for a public. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. *Early access to direct deposit funds depends on the timing of the. Need to open a bank account and have a bad credit score? Open a second chance banking account through Chime with no credit check or minimum deposit.

Best Brokerage Offers

Brokerage Bonuses & Investment Promotions ; SogoTrade, Free Trades & $ Transfer Fee Reimbursement, $+ Deposit for free trades. Transfer $10K+ for $ Interactive Brokers - the best broker for business accounts in the United States in · Ally Invest - Low trading and non-trading fees. · Merrill Edge - Low. View up-to-date forum discussions about Brokerage. RFD is your Canadian destination to find all hot deals, promotions and tips about Brokerage. Fidelity offers flexibility and customization across its digital platforms and is rated Best Broker for Low Costs by Investopedia. TD Ameritrade. TD Ameritrade. Fidelity: Fidelity is another reputable broker that offers commission-free trades on ETFs with low expense ratios. Trading fees are $0 for all ETFs and there is. Promos and offers aren't the full story · Promotion overview · Tiger Brokers · moomoo · CMC Invest · Webull · StashAway · POSB InvestSaver · POEMS Unit Trust Transfer. Always updated and kept current. These brokerage promotions and bonuses include free cash, crypto and other perks. Check out these investing promotions and brokerage bonuses that offer cash incentives, free stock rewards, investing credits, free portfolio management. These are the best brokerage account promotions from North America's top online stock brokers for this month. All are subject to change, so check back often. Brokerage Bonuses & Investment Promotions ; SogoTrade, Free Trades & $ Transfer Fee Reimbursement, $+ Deposit for free trades. Transfer $10K+ for $ Interactive Brokers - the best broker for business accounts in the United States in · Ally Invest - Low trading and non-trading fees. · Merrill Edge - Low. View up-to-date forum discussions about Brokerage. RFD is your Canadian destination to find all hot deals, promotions and tips about Brokerage. Fidelity offers flexibility and customization across its digital platforms and is rated Best Broker for Low Costs by Investopedia. TD Ameritrade. TD Ameritrade. Fidelity: Fidelity is another reputable broker that offers commission-free trades on ETFs with low expense ratios. Trading fees are $0 for all ETFs and there is. Promos and offers aren't the full story · Promotion overview · Tiger Brokers · moomoo · CMC Invest · Webull · StashAway · POSB InvestSaver · POEMS Unit Trust Transfer. Always updated and kept current. These brokerage promotions and bonuses include free cash, crypto and other perks. Check out these investing promotions and brokerage bonuses that offer cash incentives, free stock rewards, investing credits, free portfolio management. These are the best brokerage account promotions from North America's top online stock brokers for this month. All are subject to change, so check back often.

Which is the best Brokerage to buy US stocks from CAD RRSP account when it comes to exchange conversion marketingways.ru Ontario. bsobaid; Jun 7th, pm; Forum. Picking a broker simply because the broker offers a sign-up bonus is usually not a good idea. marketingways.ru Currently, we have IRA's through separate entities than our primary (local) bank, which holds checking/savings. The local bank does not offer. This brokerage is good for traders who want a wide range of assets to choose from. Interactive Brokers offers an expansive list of products compared to other. Fidelity Investments is our best overall online brokerage platform for investors due to its low fees, expansive product offering, wide-ranging full-service. Brokers can execute trades on your behalf, plus many of the top brokerage firms offer personalized services and market data to help guide you as you plan for. Best Overall National Brokerage: eXp Realty. exp realty logo. Agent Split: 80%. Transactions: , Agent Count: 86, Company Culture. Brokerage Bonuses & Investment Promotions ; SogoTrade, Free Trades & $ Transfer Fee Reimbursement, $+ Deposit for free trades. Transfer $10K+ for $ An online broker deals with customers via the internet. Investors and traders buy and sell online rather than going to a physical office. Personal brokers, who. Trade with the Best Trading Technology as rated by Benzinga's Global Fintech Awards. Offer valid for E*TRADE clients opening one new eligible brokerage. In this post, we share the best brokerage bonuses available today, including the main features and benefits that you can find with each one. Category - Brokerage Bonuses · Schwab Brokerage Bonus up to $6,; New or Existing Customers · E*Trade: Up To $4, Brokerage Bonus ($$M Required) · [Fee. I need to consolidate my financial assets over $1M (mainly brokerage account and retirement account). Who offers the best promotional incentives (for e.g. Overview of the best business brokerage accounts in the United States ; Interactive Brokers. /5. days ; Ally Invest. /5. days ; Merrill Edge. Learn more about options trading, as well as the tools and support Schwab offers. Check Writing icon. Check writing. Once your account has been funded, you. 11 Best Brokerage Bonuses ; Robinhood, 1 to 3% matching on IRA/(k) contributions + 1% Deposit Boost on taxable accounts ; Public, $5, deposit for a $ Vanguard Brokerage offers brokered CDs, which are issued by banks for See which best fits your needs. Learn about other investments. What are cash. Interactive Brokers - the best broker for business accounts in the United States in · Ally Invest - Low trading and non-trading fees. · Merrill Edge - Low. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. brokerage account is often best. If you want to keep your money in one place, the key is to find a brokerage that offers a range of investment products.

How Do Demo Trading Accounts Work

You don't need to invest anything as a Demo account (ex. Paper Trading account) is a simulation where you get a virtual deposit for trading purposes. Within minutes, the demo trading account can effectively become your risk-free practice account and can work as a free stock trading simulator also. With. A demo account is a trading simulator, where you practice your trading skills using virtual money. You can simulate buying and selling stocks, options, futures. A demo account is a virtual trading account that allows traders to practice trading strategies and gain experience without risking real money. Working of a Trading Demo Account · Your demo trading account will contain virtual, artificial money that you can use to practice different trading strategies. Market Liquidity: In demo accounts, traders might not face the same liquidity challenges they encounter in real markets. When trading large. A forex demo account enables a trader to simulate a live trading environment without placing capital at risk. Most forex brokers provide a demo account for. Risk-free learning environment: Demo accounts use virtual funds for trading, which means there is no real money lost even if you make the wrong investment. A demo trading account lets you simulate a real trading environment using fake funds instead of actual money. You don't need to invest anything as a Demo account (ex. Paper Trading account) is a simulation where you get a virtual deposit for trading purposes. Within minutes, the demo trading account can effectively become your risk-free practice account and can work as a free stock trading simulator also. With. A demo account is a trading simulator, where you practice your trading skills using virtual money. You can simulate buying and selling stocks, options, futures. A demo account is a virtual trading account that allows traders to practice trading strategies and gain experience without risking real money. Working of a Trading Demo Account · Your demo trading account will contain virtual, artificial money that you can use to practice different trading strategies. Market Liquidity: In demo accounts, traders might not face the same liquidity challenges they encounter in real markets. When trading large. A forex demo account enables a trader to simulate a live trading environment without placing capital at risk. Most forex brokers provide a demo account for. Risk-free learning environment: Demo accounts use virtual funds for trading, which means there is no real money lost even if you make the wrong investment. A demo trading account lets you simulate a real trading environment using fake funds instead of actual money.

Like the real thing, demo accounts allow you to monitor and track the market. It is designed to follow exchange rates available on real accounts. How Do Forex Demo Accounts Work? In a Forex demo account, you can make the same decisions as in an account with real funds and check live price quotations. Create a trading demo account here. Practice trading risk-free with $ in virtual funds and live prices on 80+ FX pairs using our demo platform. What is a Forex Demo Account? A forex demo account enables a trader to simulate a live trading environment without placing capital at risk. Most forex brokers. A Forex demo account enables a trader to simulate a live trading environment - without putting any real money at risk. You can try our web platform and mobile app risk-free by using a demo account. You'll find much of the functionality very similar to using a live account, but. A Forex demo account is a virtual trading account where you can trade with virtual funds. It's connected to a live trading platform so it still receives real-. No risk. You will not lose real money if you make losses due to wrong decisions. · Self-analysis. Working on a demo account allows you to identify all your. However, with a tastyfx demo trading account, you'll gain access to over 80 FX pairs. What can you do on a demo trading account? You can open and close positions, adjust your order types and choose from hundreds of different financial instruments. Your trading platform works exactly the. A demo trading account lets you simulate a real trading environment using fake funds instead of actual money. You can use a trading simulator, such as a demo account, to enable you to get to grips with a platform, build your strategy and grow in confidence, without. Demo trading conditions are almost the same as those on live trading accounts. The main difference is that a demo account is risk-free, as you can use it. Virtually invest up to $K to see how your trades would perform. It's the best way to demo your trades and try out strategies before putting up real. Demo accounts usually replicate the features and functionality of live trading platforms. This allows you to get familiar with the user interface, tools, and. How long does a demo account last? Demo accounts last for 90 days after sign up. Afterward, you will not be able to log in using the demo account credentials. A forex demo account is a virtual trading account where you can trade virtual funds. It is connected to a live trading platform, so it still receives live. How does a Demo Account work? With the start of internet trading, demo accounts have become increasingly common and are promoted to users as a risk-free. 1. To make a deposit on a demo account in MT4, you do not need to perform any extra steps. You top it up in the same way as. How Does a Forex Demo Account Work? · Reading Time: 10 Minutes · A forex demo account enables a trader to simulate a live trading environment without placing.

Can You File A 1099

Who Should Receive Form NEC? They should use Form NEC to file their U.S. federal income tax and state tax returns (usually on Schedule C). It is important to note that, unlike a Form W-2 correction form, Form W-2c, there is no separate correction form. It is the same form as the original File your with the IRS for free. Free support for self-employed income, independent contractor, freelance, and other small business income. The required W-2 and statements must be filed directly with the Department. For additional details, see this FAQ if you are required to file Form NC-3 and. File Online with IRS approved eFile Service provider Tax eFile MISC and more IRS forms eFiling is secure and easy by importing data. If the entity you paid for services is an S-Corp or C-Corp, you do not need to issue a NEC unless the payment was for legal services. Legal services are. You're ready to start e-filing your income tax return, only to discover that you're missing a Form Now what? No problem: You can e-file without the. Who Must File Form ? You do not usually have to submit the forms you receive to the IRS with your tax return, but you should keep them with your. The basic rule is that you must file a NEC whenever you pay an unincorporated independent contractor—that is, an independent contractor who is a sole. Who Should Receive Form NEC? They should use Form NEC to file their U.S. federal income tax and state tax returns (usually on Schedule C). It is important to note that, unlike a Form W-2 correction form, Form W-2c, there is no separate correction form. It is the same form as the original File your with the IRS for free. Free support for self-employed income, independent contractor, freelance, and other small business income. The required W-2 and statements must be filed directly with the Department. For additional details, see this FAQ if you are required to file Form NC-3 and. File Online with IRS approved eFile Service provider Tax eFile MISC and more IRS forms eFiling is secure and easy by importing data. If the entity you paid for services is an S-Corp or C-Corp, you do not need to issue a NEC unless the payment was for legal services. Legal services are. You're ready to start e-filing your income tax return, only to discover that you're missing a Form Now what? No problem: You can e-file without the. Who Must File Form ? You do not usually have to submit the forms you receive to the IRS with your tax return, but you should keep them with your. The basic rule is that you must file a NEC whenever you pay an unincorporated independent contractor—that is, an independent contractor who is a sole.

Effective December 1, , for all tax years - Printable wage and information returns should be formatted to print one taxpayer per page. · Use the following. File Form MISC with the IRS by February 28, , if you file on paper, or April 1, , if you file electronically.” Business payers must issue s on. This will transfer the federal/state withholding to the appropriate line(s) of the returns. The actual Form MISC is not e-filed with the return, only the. Electronic Filing Requirements. If you file 25 or more Forms MISC, R, K, NEC, or W-2G you. If you paid someone for services (other than employees) you must issue them a by January 31 of the following year. For businesses, filing electronically is a requirement for any taxpayer with $ average quarterly liability for withholding tax during the prior tax year. If you've received a Form instead of an employee W-2, your company is treating you as a self-employed worker. This is also known as an independent. Form MISC is the exception: paper filed due February 28, electronically filed due March I need a copy of a W2 of filed with Treasury. How can I. If you're running a platform or marketplace, you may be required to file tax forms with the IRS and state authorities. A tax form is used to. If you earned $ or more during the year (regardless of whether you received s for that work), you'll need to file an income tax return when tax time. You should receive your Form (s) in the mail or electronically, or you may be able to access them in your financial institution account. If you haven't. Usually, if you work and want to file a tax return, you need Form W-2 or Form , provided by your employer. If you did not receive these forms or misplaced. The filing deadline for W-2s and s is February · W-2s and s must be filed using GovConnectIowa. · What Permit Number should you use to file? No. You do not normally need to issue NECs to businesses that are registered as S Corporations or C Corporations. Note that there are a few specific types. There are four general rules for when you need to file a Form Your bookkeeping services can help you track your payments and issue the appropriate forms. Basic NEC Filing Instructions To complete a NEC, you'll need to supply the following data: Business information – Your Federal Employer ID Number . After You File. Check E-File StatusPrint / Download My Return. Form NEC Deluxe ServiceExtension Tax FilingSelf-Employed TaxesMilitary Taxes TaxesPro. PPACA would have expanded this to include purchases of goods and purchases from corporations. Businesses who currently file dozens of s a year would have. You fill out all your information under the company settings, Under the vendor use the W-9 to complete the vendor information, and check off the.

First Savings Mastercard Credit Limit

Your account is reviewed for a CREDIT LINE INCREASE after the first 6 months. © Blaze Mastercard Credit Card, issued by First Savings Bank, pursuant to a. The credit limit is determined by your creditworthiness and will be in an amount between $ – $5, The variable APR for purchases is %. There is a. First Savings Credit Card has changed its name to HUE. You may notice a few changes, but you'll still receive the same great services and benefits. Secured Card: Late payments or going over the credit limit may damage your credit history. Your credit limit will be equal to the amount of your security. Credit cards that fit your lifestyle ; Maximum Rewards · Visa SignatureCard. Unlimited rewards. Every purchase. Every day. · Choose Your Rewards ; Platinum Edition. There's no limit to the points you can earn, and you can redeem them for cash back, travel and merchandise. IS_marketingways.ru Your Mastercard is. I think that is discriminative to charge the minimum amount plus the over limit fee. You can never pay it off. Read Have questions about your First Savings Credit Card? Visit our customer service contact page. Get Rewarded! Make your First Savings Mastercard® Credit Card your everyday companion and you'll have instant credit at your fingertips. Earn $1 for every. Your account is reviewed for a CREDIT LINE INCREASE after the first 6 months. © Blaze Mastercard Credit Card, issued by First Savings Bank, pursuant to a. The credit limit is determined by your creditworthiness and will be in an amount between $ – $5, The variable APR for purchases is %. There is a. First Savings Credit Card has changed its name to HUE. You may notice a few changes, but you'll still receive the same great services and benefits. Secured Card: Late payments or going over the credit limit may damage your credit history. Your credit limit will be equal to the amount of your security. Credit cards that fit your lifestyle ; Maximum Rewards · Visa SignatureCard. Unlimited rewards. Every purchase. Every day. · Choose Your Rewards ; Platinum Edition. There's no limit to the points you can earn, and you can redeem them for cash back, travel and merchandise. IS_marketingways.ru Your Mastercard is. I think that is discriminative to charge the minimum amount plus the over limit fee. You can never pay it off. Read Have questions about your First Savings Credit Card? Visit our customer service contact page. Get Rewarded! Make your First Savings Mastercard® Credit Card your everyday companion and you'll have instant credit at your fingertips. Earn $1 for every.

What is the daily limit on my debit card? If you apply for a Personal Unsecured Credit Card by 8/31/24 and are approved, get a $50 statement credit with a new Pure Checking Account or a $ Credit Cards ; Essential · When you use your Mastercard, you're protected against fraud with Zero Liability Protection8. $ minimum credit limit. ; Life Rewards. We also offer a Secured Credit Card that will help you establish a solid credit history or rebuild your credit rating. Experience Michigan First Rewards® Visa®. Log into your account to check your balance, pay your bill, review transactions, and more First Savings. Username. Password. Register new user Forgot Username. Share Secured Credit Card ; Foreign Transaction, None ; Penalty Fees ; Late Payment, Up to $ ; Over-the-Credit-Limit, None. Savings Account that earns interest. Your credit limit will be tied to your required deposit amount. Use your card responsibly and build your credit. How to Request a Credit Limit Increase From First Savings On Your Own · Log into your account online and find the application for a credit increase. Fill it out. We will help you get started on your path to financial freedom with Legacy Visa credit card by First National Bank. What You Get with Every Mastercard · No cash advance, annual or balance transfer fees. EMV chip-enabled technology to help protect you from fraud. · Apple Pay®. Find out First Savings Bank Credit Cards alternatives. Choose the good one for you and fulfill online application. About this app. arrow_forward. Access your HUE and First Savings Mastercard® Credit Card by First Savings Bank anywhere, anytime. The look and branding are. Home Equity Line of Credit · Home Equity Loan · View All · Meet Our Team Spend $1, on your credit card in the first 3 months after your account is. Because many consumers apply for store cards as their first credit card, your first credit limit is generally going to be on the low end. Though Equifax notes. Your credit limit is secured by a refundable security deposit, and you get all the great benefits of our Platinum Rewards Mastercard. Your on-time payments are. There is a $95 annual fee for the Mastercard World that is waived for the first year from account opening. credit limit fee. † For World cardholders only. ††. The card automatically comes with a $ credit limit which allows you a chance to have access to credit without getting in over your head. Your timely payments. The Credit Limit is the maximum amount of credit that we may make as of the date you first accepted this Card. Page Agreement. We may close. You will earn 25, bonus points if you use your new credit card account to make any combination of Purchase transactions totaling at least $3, (exclusive. AF Debit Mastercard®. As your financial partner, we want you to have all the Get the funds you need when you need them with a revolving line of credit.

Sofi Growth Potential

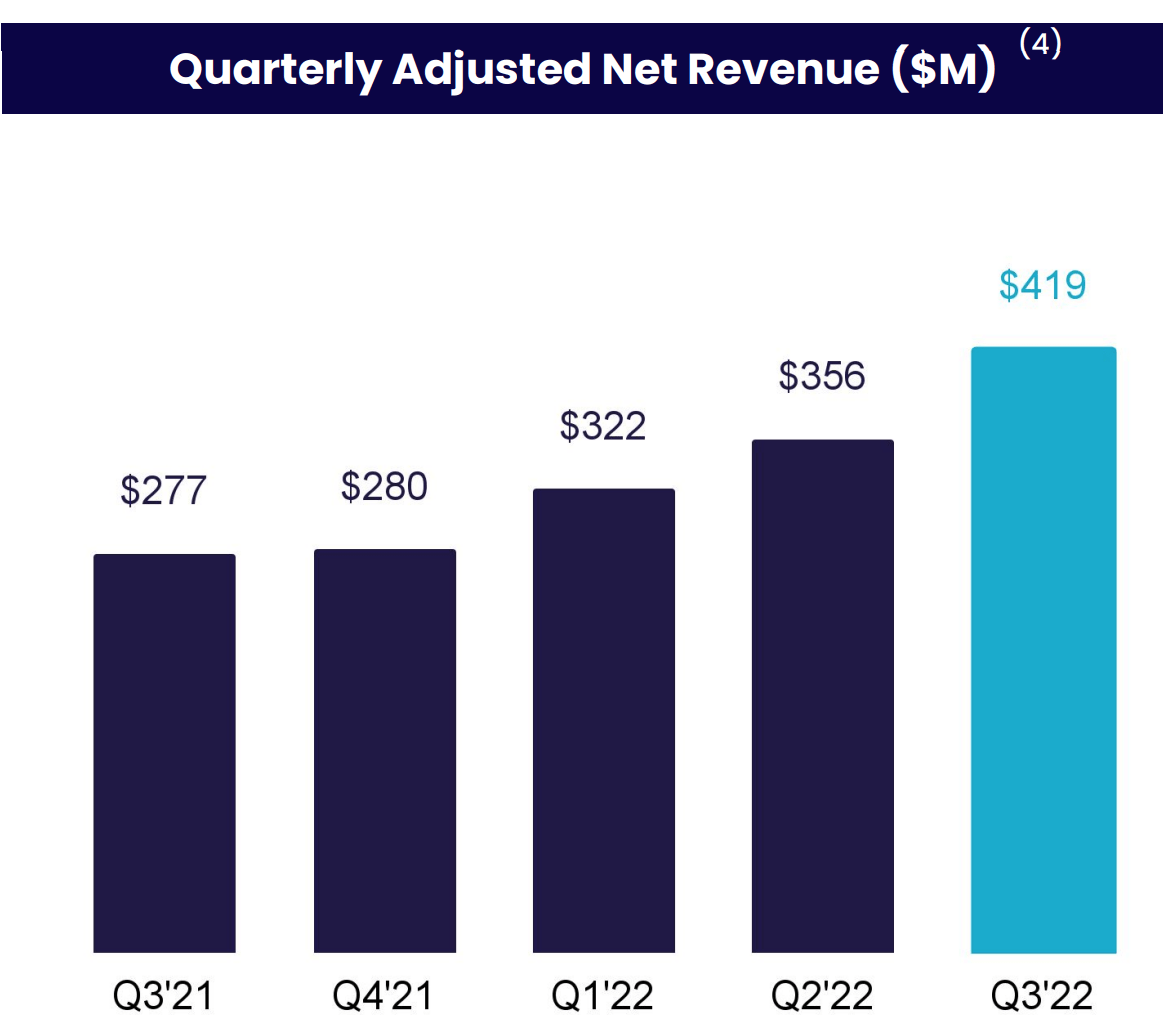

in is 5,MM.) Understanding a company's revenue history gives investors a snapshot of its potential growth. Revenue growth is a solid predictor of. Growth stocks are shares of companies that demonstrate a strong potential to increase revenue or earnings thereby ramping up their stock price. The terms value. Sofi is only x book with a insane growth rate. Upvote Downvote Its a speculative play, Its also a potential acquisition target for. grow your savings no matter how small you're starting out. You can Additional information can be found at marketingways.ru Management continues to expect growth in tangible book value of approximately $ million to $1 billion and continues to expect to end the year with a total. As such, I think the company has managed to reach a place where investors can stop worrying about the profitability or the member growth. It is aiming for a. Provides various financial services in the United States, Latin America, and Canada. Reasonable growth potential with adequate balance sheet. Data. Investment opportunities are ways investors may be able to grow their money. Here are 7 ideas for Learn more. Potential and Robust Financial Position by TipRanks Aug 05 am ET KBW Growth and Marketing Spend Balance Out in Hold Rating by TipRanks Jul 31 8. in is 5,MM.) Understanding a company's revenue history gives investors a snapshot of its potential growth. Revenue growth is a solid predictor of. Growth stocks are shares of companies that demonstrate a strong potential to increase revenue or earnings thereby ramping up their stock price. The terms value. Sofi is only x book with a insane growth rate. Upvote Downvote Its a speculative play, Its also a potential acquisition target for. grow your savings no matter how small you're starting out. You can Additional information can be found at marketingways.ru Management continues to expect growth in tangible book value of approximately $ million to $1 billion and continues to expect to end the year with a total. As such, I think the company has managed to reach a place where investors can stop worrying about the profitability or the member growth. It is aiming for a. Provides various financial services in the United States, Latin America, and Canada. Reasonable growth potential with adequate balance sheet. Data. Investment opportunities are ways investors may be able to grow their money. Here are 7 ideas for Learn more. Potential and Robust Financial Position by TipRanks Aug 05 am ET KBW Growth and Marketing Spend Balance Out in Hold Rating by TipRanks Jul 31 8.

Growth stocks are shares of companies that demonstrate a strong potential to increase revenue or earnings thereby ramping up their stock price. The terms value. Valuation metrics indicate that SoFi's stock is currently trading at a significant discount relative to its peers in the fintech sector, suggesting a potential. National Average is based on the FDIC monthly savings account rate as of August 19, increase after the Direct Deposit Bonus Period. Direct. APRs for variable-rate loans may increase after origination if the SOFR index increases. The SoFi % autopay interest rate reduction requires you to. The potential, however, appears to be in place for SoFi to rebound and deliver strong returns if current growth trends continue without interruption. SoFi has. Analyst Future Growth Forecasts Earnings vs Savings Rate: SOFI is forecast to become profitable over the next 3 years, which is considered faster growth than. Years of growth. Years. Estimated rate of return. Compound frequency. Daily, Monthly, Annually. Calculate. Total Balance SoFi Checking and Savings. SoFi Bank. Despite trading below peak, the company shows strong financial health and growth potential in the fintech sector. SoFi's strong financial performance. High growth rate in member base. Over the past year, SoFi has experienced a member growth rate of 45%. By Q3 , membership count increased from million. Triple-digit growth in SoFi Money and SoFi Invest products were the largest drivers of the % year-over-year increase in total Financial Services products. Downside of Growth Mutual Funds. Like any other investment, there are potential drawbacks to keep in mind with growth stocks and their growth fund counterparts. (NASDAQ: SOFI) Sofi Technologies's forecast annual earnings growth rate of N/A is not forecast to beat the US Credit Services industry's average forecast. Expanding SoFi's services into areas like banking and wealth management presents significant growth opportunities, but it also exposes the company to increased. TTM free cash flow growth of 0% is in the bottom 25% of its industry. · Negative price to free cash flow ratio of is a potential red flag. · Negative free. Investment opportunities are ways investors may be able to grow their money. Here are 7 ideas for Learn more. Investor reactions could be linked to broader market sentiments or specific apprehensions regarding SoFi's growth prospects in an evolving financial landscape. Others may invest in tech stocks on a more long-term basis, holding onto their shares for several years to benefit from any potential long-term growth. What. Time to grow. Years. Annual interest rate. Compound frequency. Daily, Monthly, Annually. Calculate. Total Balance SoFi Checking and Savings. SoFi Bank, N.A. It is based on its current growth rate as well as the projected cash flow expected by the investors. This tool provides a mechanism to make assumptions about. SoFi Technologies has a beta of As the market goes up, the company is expected to outperform it. However, if the market returns are negative, SoFi.

Best Saver Bank Accounts

Our top picks for the best high-yield savings account rates are SoFi Bank (%), Bask Bank (%) and Discover Bank (%), but rates are as high as. Some of the top-earning savings accounts are still offering rates over 5%, significantly higher than the national average for traditional savings accounts. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. A savings account is an account at a bank or credit union that is designed to hold your money. Savings accounts typically pay a modest interest rate. Explore and compare American Savings Bank's savings accounts and select one that best suits your savings goals with Hawaii's best bank. Whether you want an easy access savings account or a fixed rate account, we've got great deals from a wide range of providers. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Traditional savings accounts. Standard Savings Account. Best for. First-time savers; Carrying a lower balance; Creating multiple savings goals; Instant access. Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance Savings · SoFi Checking and Savings. Our top picks for the best high-yield savings account rates are SoFi Bank (%), Bask Bank (%) and Discover Bank (%), but rates are as high as. Some of the top-earning savings accounts are still offering rates over 5%, significantly higher than the national average for traditional savings accounts. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. A savings account is an account at a bank or credit union that is designed to hold your money. Savings accounts typically pay a modest interest rate. Explore and compare American Savings Bank's savings accounts and select one that best suits your savings goals with Hawaii's best bank. Whether you want an easy access savings account or a fixed rate account, we've got great deals from a wide range of providers. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Traditional savings accounts. Standard Savings Account. Best for. First-time savers; Carrying a lower balance; Creating multiple savings goals; Instant access. Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance Savings · SoFi Checking and Savings.

Some of the top-earning savings accounts are still offering rates over 5%, significantly higher than the national average for traditional savings accounts. What are regular savings accounts? · Should I get a regular savings account? · Top existing-customer accounts. Virgin Money – % fixed; First Direct – 7%. Open a savings account with First Hawaiian Bank, the best bank in Hawaii Take control of your retirement plans with Individual Retirement Accounts (IRAs) that. Our savings accounts · Truist One Savings · Truist One Money Market Account · Truist Certificates of Deposit · Truist Confidence Savings. The Fortune Recommends team evaluated more than 60 high-yield savings accounts to find you the top picks. This account offered by Bank of America for Wealth Management clients offers tiered interest rates, discounts and waivers on everyday banking services. Find the top interest rate savings accounts & maximise your returns with Martin Lewis' guide. Includes the top easy access and fixed-rate accounts to help. Top high-yield savings accounts have above-average APYs, no minimum deposits and zero monthly fees. Here are the best savings rates on the market. With interest rates cut for the first time in more than four years, lenders are dropping their rates. Find the top interest rate savings accounts & maximise your returns with Martin Lewis' guide. Includes the top easy access and fixed-rate accounts to help. Benefits of Chase Savings Earn interest interest. ATM & branches. Access to 15, ATMs and more than 4, branches. Online & mobile banking. Manage. Savings accounts with FDIC member banks and with NCUA-insured credit unions offer coverage of up to $, per depositor, per account. Not every bank or. A savings account is an account at a bank or credit union that is designed to hold your money. Savings accounts typically pay a modest interest rate. We offer a wide range of savings account options — from simple savings accounts to goal-based solutions and retirement savings options. Bank of America Advantage Savings · Bank of America Certificate of Deposit (CD) · Bank of America Individual Retirement Account (IRA). Is there a. Compare accounts with competitive, variable interest rates, waivable fees, and great digital tools to help you stay in control of your money. Set up your kids for financial success early. Learn how to open and use a savings account for your child with this article from Better Money Habits. CNBC Select ranked the top high-yield savings accounts and the best overall pick from an online bank is the Marcus by Goldman Sachs High Yield Online Savings. What should I consider when comparing savings accounts? · Interest rate vs access – most easy-access accounts offer a lower interest rate than other savings.

What Does It Mean To Be Declared Bankrupt

:max_bytes(150000):strip_icc()/Term-b-bankruptcy-2b3195a79ddb4408a7d4461b56058b5a.jpg)

Bankruptcy is a legal process where you're declared unable to pay your debts. It can release you from most debts, provide relief and allow you to make a fresh. Filing a proof of claim only means you are listing your past-due amounts for consideration of payment by the bankruptcy trustee. There is no guarantee those. Bankruptcy is meant for individuals who cannot make progress in paying down their debts. If this describes your situation, declaring bankruptcy can provide you. meaning that the bankrupt estate has no non-exempt assets to fund a declare bankruptcy, paying less than the original company would have. Any credit you do get is likely to be expensive both now and in the future. Bankruptcy affects your credit rating and credit reference agencies will keep your. People or organizations that go bankrupt do not have enough money to pay their debts. A bankrupt is a person who has been declared bankrupt by a court of law. Personal bankruptcy is a legal process designed to help an honest but unfortunate debtor who cannot afford to repay their debts find debt relief. Bankruptcy distributes your assets among the creditors you owe money to and protects you from these creditors. The distribution is done through a court official. Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. Bankruptcy is a legal process where you're declared unable to pay your debts. It can release you from most debts, provide relief and allow you to make a fresh. Filing a proof of claim only means you are listing your past-due amounts for consideration of payment by the bankruptcy trustee. There is no guarantee those. Bankruptcy is meant for individuals who cannot make progress in paying down their debts. If this describes your situation, declaring bankruptcy can provide you. meaning that the bankrupt estate has no non-exempt assets to fund a declare bankruptcy, paying less than the original company would have. Any credit you do get is likely to be expensive both now and in the future. Bankruptcy affects your credit rating and credit reference agencies will keep your. People or organizations that go bankrupt do not have enough money to pay their debts. A bankrupt is a person who has been declared bankrupt by a court of law. Personal bankruptcy is a legal process designed to help an honest but unfortunate debtor who cannot afford to repay their debts find debt relief. Bankruptcy distributes your assets among the creditors you owe money to and protects you from these creditors. The distribution is done through a court official. Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts.

deplete, drain, exhaust, impoverish, bankrupt mean to deprive of something essential to existence or potency. deplete implies a reduction in number or quantity. Bankruptcy is a legal process by which you may be discharged from most of your debts. Its purpose is to permit an honest, but unfortunate debtor to obtain a. Declaring bankruptcy is a legal process that is meant to formally convey to the government / creditors / various financial institutions that you don't have any. Bankruptcy is meant for individuals who cannot make progress in paying down their debts. If this describes your situation, declaring bankruptcy can provide you. Bankruptcy is a legal process that provides immediate relief from your unsecured debt burden, the most common example being credit card debt. Insolvency is a financial state where a person cannot meet debt payments on time. Bankruptcy is a legal process that happens when the individual declares he or. In additional you are forbidden from being a director of a company while bankrupt. Should You Declare Bankruptcy? It is true that there is a cost to declaring. A chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter Instead, the bankruptcy trustee gathers and sells the debtor's. If you can't pay your debts, then you may be declared bankrupt. In order to be made bankrupt, a court will have to issue an order against you. Call – at the U.S. Bankruptcy Courts and follow the prompts. Effect of bankruptcy on taxes. Chapter, Who can file, Purpose, Length, Prepetition. Bankruptcy is a legal status that usually lasts for a year and can be a way to clear debts you can't pay. When you declare bankruptcy, you will file a petition in federal court. Once your petition for bankruptcy is filed, your creditors will be informed. You might be able to declare yourself bankrupt if you can't pay your debts and the amount you owe is more than the value of the things you own. Bankruptcy, the status of a debtor who has been declared by judicial process to be unable to pay his debts. Most unsecured debts are covered in bankruptcy - this means you no longer have to repay these debts. There are some exceptions. For more information see: What. What is bankruptcy? Bankruptcy is a legal process to help people who owe money, or debtors, get relief from debts they cannot pay and, at the same time. People who file for Chapter 7 bankruptcy or Chapter 13 bankruptcy find relief from debts but face new challenges. They must rebuild their credit. “Bankruptcy” is a federal law that establishes an orderly process to provide protection to debtors and fair treatment to creditors. Bankruptcy proceedings. As the debtor, you will be declared a bankrupt if the court makes a bankruptcy order against you. You will need to fulfil duties as a bankrupt. Definition: When an organisation is unable to honour its financial obligations or make payment to its creditors, it files for bankruptcy. A petition is filed in.

Hicox Fund

HICOX $15, Bloomberg Municipal TR USD $12, Category Average $11, Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM). Fund Description. Incepted in , Freedom Funds Management Company manages the fund. The fund's primary goal is to maximize income that is exempt from. Colorado Bond Shares A Tax Exempt Fund HICOX. NAV, Change, Net Expense Ratio Portfolio Turnover, 6%. Fund Company, Freedom Funds, ESG Fund. ESG Fund. Don't let mutual funds siphon away your returns. The Colorado BondShares A Tax-Exempt fund (HICOX) is a Muni Single State Interm fund started on 06/4/ and. HICOX Colorado Bond Shares A Tax Exempt Fund A. Holdings and Sector Allocations. Follow. $ (+%)07/05/ Mutual Fund | $USD | NAV. Summary. See holdings data for Colorado Bondshares A Tax Exempt Fund (HICOX). Research information including asset allocation, sector weightings and top holdings for. View the latest Colorado Bond Shares-A Tax-Exempt Fund (HICOX) stock price, news, historical charts, analyst ratings and financial information from WSJ. Fund Details. Fund Strategy. The investment seeks to maximize income that is exempt from both federal and Colorado state income taxes while simultaneously. The investment seeks to maximize income that is exempt from both federal and Colorado state income taxes while simultaneously preserving capital;. HICOX $15, Bloomberg Municipal TR USD $12, Category Average $11, Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM). Fund Description. Incepted in , Freedom Funds Management Company manages the fund. The fund's primary goal is to maximize income that is exempt from. Colorado Bond Shares A Tax Exempt Fund HICOX. NAV, Change, Net Expense Ratio Portfolio Turnover, 6%. Fund Company, Freedom Funds, ESG Fund. ESG Fund. Don't let mutual funds siphon away your returns. The Colorado BondShares A Tax-Exempt fund (HICOX) is a Muni Single State Interm fund started on 06/4/ and. HICOX Colorado Bond Shares A Tax Exempt Fund A. Holdings and Sector Allocations. Follow. $ (+%)07/05/ Mutual Fund | $USD | NAV. Summary. See holdings data for Colorado Bondshares A Tax Exempt Fund (HICOX). Research information including asset allocation, sector weightings and top holdings for. View the latest Colorado Bond Shares-A Tax-Exempt Fund (HICOX) stock price, news, historical charts, analyst ratings and financial information from WSJ. Fund Details. Fund Strategy. The investment seeks to maximize income that is exempt from both federal and Colorado state income taxes while simultaneously. The investment seeks to maximize income that is exempt from both federal and Colorado state income taxes while simultaneously preserving capital;.

Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current. (HICOX) is an actively managed Municipal Bond Muni Single State Interm fund. Freedom Funds launched the fund in The investment seeks to maximize income. The Weiss investment rating of Colorado Bond Shares A Tax Exempt Fund (NASDAQ: HICOX) is C. Colorado Bond Shares-A Tax-Exempt Fund advanced mutual fund charts by MarketWatch. View HICOX mutual fund data and compare to other funds, stocks and. Find the latest Colorado BondShares A Tax-Exempt (HICOX) stock quote, history, news and other vital information to help you with your stock trading and. Find our live Colorado Bond Shares A Tax Exempt Fund fund basic information. View & analyze the HICOX fund chart by total assets, risk rating. Get Colorado Bond Shares A Tax Exempt Fund (HICOX.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. Want push notifications sent directly to your devices for fund price changes and breaking news stories? HICOX. Manager & start date. Fred Kelly. 01 Nov. The Fund is designed for investors subject to income taxation in the higher tax brackets who can take advantage of the tax-exempt nature of the Fund's income. A high-level overview of Colorado Bond Shares A Tax Exempt Fund A (HICOX) stock. Stay up to date on the latest stock price, chart, news, analysis. HICOX Portfolio - Learn more about the Colorado BondShares A Tax-Exempt investment portfolio including asset allocation, stock style, stock holdings and. To achieve the Fund's investment objective, under normal market conditions, the Fund will attempt to invest up to % and, except for temporary investments. Get the latest Colorado Bond Shares A Tax Exempt Fund (HICOX) real-time quote, historical performance, charts, and other financial information to help you. Colorado Bondshares etfs funds price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. See holdings data for Colorado Bondshares A Tax Exempt Fund (HICOX). Research information including asset allocation, sector weightings and top holdings for. Colorado BondShares A Tax-Exempt (HICOX). Follow. + (+%). As While the investment objective stated in a fund's prospectus may or may not. News Profile Fund Overview Fund Holdings Fund Performance Dividends Price History. Colorado BondShares News. INVESTING. Jan 16, PM EST. Six Bond Funds. Hiscox offers business insurance customized to your specific business needs. Helping the courageous overcome the impossible. Get a quote now! A high-level overview of Colorado Bond Shares A Tax Exempt Fund A (HICOX) stock. Stay up to date on the latest stock price, chart, news, analysis. Colorado BondShares (HICOX) - Price and Analysis - mutual fund quote, history, news, and other vital information to help you with your stock trading and.

Legal Zoom Reviews

LegalZoom is not a law firm and does not provide legal advice, except where authorized through its subsidiary law firm LZ Legal Services, LLC. Use of our. Legal Zoom Reviews from many of the top employers and consultants. See how Legal Zoom compares to their top competitors and understand their important. LegalZoom ties for the No. 6 spot in our ratings of LLC formation services. The company sells a full range of legal services for businesses and individuals. LegalZoom has reviews (average rating ). Consumers say: Deceptive and intentional scam by Legal Zoom Legal Forms Monthly Subscription. These LegalZoom trademark reviews allow you to gain insight into how your own LegalZoom experience may turn out before you risk a single dime. Do you agree with LegalZoom's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews out of. Generally speaking, you can save 85% of the cost of an attorney by using marketingways.ru Sounds pretty enticing. They have very simple questionnaires that are. Overview. LegalZoom has a rating of stars from 1, reviews, indicating that most customers are generally satisfied with their purchases. Reviewers. Yes, LegalZoom is legitimate. Since launching in , LegalZoom has helped more than 4 million people. Customers praise the company for its quick services. LegalZoom is not a law firm and does not provide legal advice, except where authorized through its subsidiary law firm LZ Legal Services, LLC. Use of our. Legal Zoom Reviews from many of the top employers and consultants. See how Legal Zoom compares to their top competitors and understand their important. LegalZoom ties for the No. 6 spot in our ratings of LLC formation services. The company sells a full range of legal services for businesses and individuals. LegalZoom has reviews (average rating ). Consumers say: Deceptive and intentional scam by Legal Zoom Legal Forms Monthly Subscription. These LegalZoom trademark reviews allow you to gain insight into how your own LegalZoom experience may turn out before you risk a single dime. Do you agree with LegalZoom's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews out of. Generally speaking, you can save 85% of the cost of an attorney by using marketingways.ru Sounds pretty enticing. They have very simple questionnaires that are. Overview. LegalZoom has a rating of stars from 1, reviews, indicating that most customers are generally satisfied with their purchases. Reviewers. Yes, LegalZoom is legitimate. Since launching in , LegalZoom has helped more than 4 million people. Customers praise the company for its quick services.

LegalZoom is beyond predatory. They get you into a subscription that renews itself without notice. They use an opt in method which allow them to charge. LegalZoom: We found 6,+ reviews for LegalZoom, and while they do have legal guidance, standard or complex tax returns, a legal protection plan. In this review, we will discuss our experience with LegalZoom's estate planning services, the pros and cons, and how LegalZoom stacks up against the. LegalZoom has amazing user experience and an intuitive platform. Registering a business and LLC formation is a breeze, all you have to do is answer a set of. Overall, LegalZoom offers great online legal services with several beneficial features, such as a QuickBooks subscription and educational member resources. LegalZoom is a full-service online company that provides comprehensive legal support for individuals and small businesses. LegalZoom provides customers with an easy and fast alternative for creating a last will and testament online. LegalZoom has significant brand power due to its consistent advertising efforts, and it has plenty of experience. The company is also currently offering LLC. LegalZoom is not a lawyer's office, you're not getting the guidance and expertise of a lawyer even though you're still paying ridiculous prices for their. Overall, LegalZoom offers great online legal services with several beneficial features, such as a QuickBooks subscription and educational member resources. Legal Zoom has horrible customer service. They are a subscription service, so beware. Even after you stop using them months and years later, they will charge. Based on 70 customer reviews from our shopper community, LegalZoom's overall rating is out of 5 stars and 87% of reviewers recommend this brand, which. LegalZoom charges $ per year for their registered agent services. This is a decent price given that it takes a lot of pressure off of your back. LegalZoom is generally considered a credible and reputable online legal services provider. However, the credibility of specific legal documents. When you pay LegalZoom to register your business entity, standard turnaround times can be up to two weeks or more, depending on the company type and the state. Overview. LegalZoom has a rating of stars from 1, reviews, indicating that most customers are generally satisfied with their purchases. Reviewers. Relatively easy way to handle the legal work to start your business. Fairly inexpensive and quick service for the most part. Nothing great about it, but it met. Your LegalZoom legal plan covers attorney review of documents up to 10 pages at no extra charge. · The Legal Document Review provides the same service for. LegalZoom charges $ per year for their registered agent services. This is a decent price given that it takes a lot of pressure off of your back. LegalZoom is an excellent service for those looking to get well crafted boiler plate forms created for a wide variety of filings that do not.

1 2 3 4